Auto Enrolment is here! Every employer has to work on it and nearly all employers have to make significant changes to their employment, payroll and pension processes just to stay within the law. Breach can bring stiff financial penalties.

The good news is that as time goes on, more and more employers say they know about Auto Enrolment (AE). They don’t like it. They know it will add cost to their business but most know they have to do something about it.

The bad news is that most employers don’t realise how very difficult compliance with the new law is and how they will need more time and expertise than they probably have. The level of complexity AE adds to their administrative processes and the amount of analysis and communication they have to do with each worker is daunting, however well-resourced the company.

Companies who have been through their AE staging date have found the process painful and some are still trying to get to full compliance. In February 2014 the Pensions Regulator announced they were investigating 590 companies. During 2014 for approximately 50,000 companies staging, with 3m plus workers, many are in terrible need of expert help and most dont really know it. Employers assume a pension product is all they need. Not so. The legislation is complex but flexible and strategic decsions should be made. Most will be sold an off the shelf product which does little to cater to how they would like to implement AE for their company and workforce. For the medium and smaller companies who are still to go through the process most commentators are saying they will have profound difficulties without expert help.

No wonder! The concept of auto enrolment may seem simple but the application makes other HR, payroll and pension requirements look like a walk in the park.

For one thing, the legislation makes it all the employer’s responsibility and secondly makes the regulator legally bound to enforce it. So it’s not like stakeholder pensions where there was little compliance and less enforcement. Under Auto Enrolment the fines are serious amounts and criminal prosecutions can follow.

The king of all devils is in the Auto Enrolment detail. Companies who have been through the process say they should have:

Many employers think their payroll or pension providers will do it all for them but this is not the case. Most of the work is in the employer’s admin, personnel and benefits strategy. The payroll and pensions systems are just the recipients of decisions that must be made. There are important choices to make and not all payroll and pension providers offer all the flexibility Auto Enrolment allows.

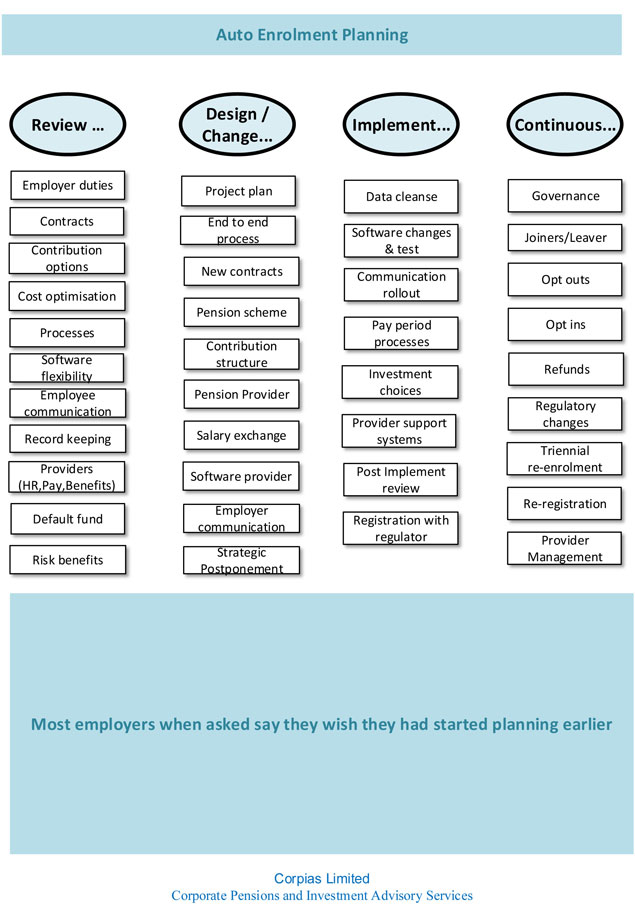

Below we show the main elements that you should include in your Auto Enrolment project. Many of them need to be done in parallel if you are going to make use of a limited time scale. There is a consensus that six months is the minimum time estimate but many companies will take longer. Beyond staging date the difficulties of maintaining continuous compliance start but that’s another story.

For further information or help on your company pensions or auto enrolment issues, please contact Alan Salamon at CORPIAS for a conversation without obligation on 07975 979233. For company pensions news and views you may not see elsewhere sign up for my newsletter.