CORPIAS NEWSLETTER

Pensions News Bulletin November – December 2014

What you wanted to know about pension investment fees but dared not ask

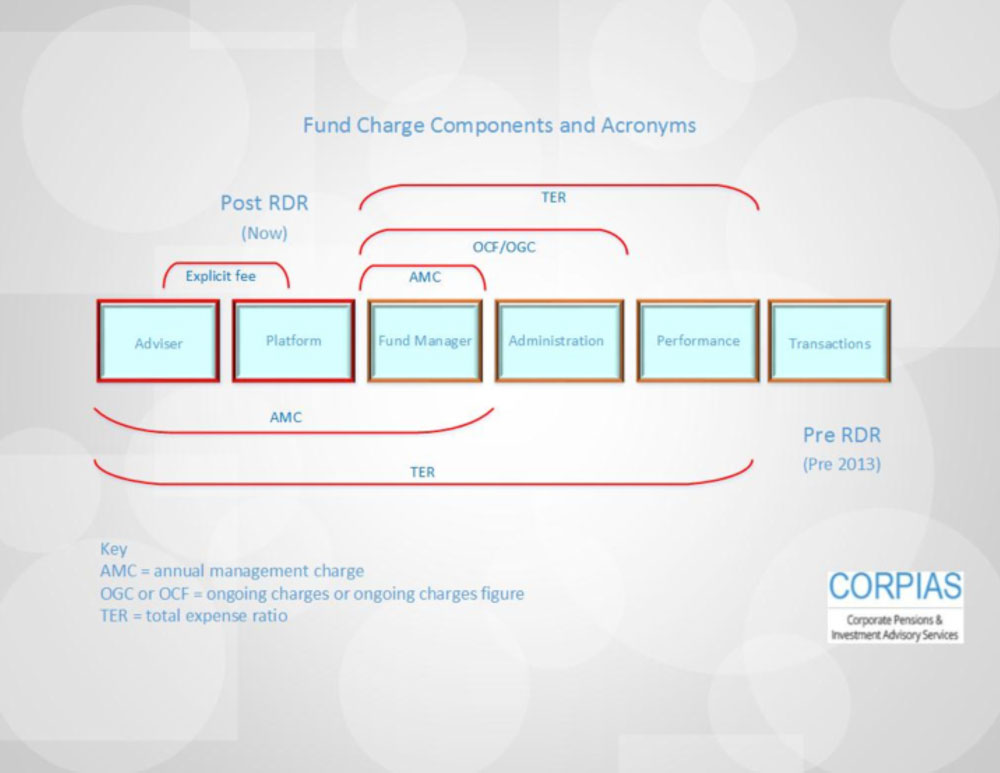

Most people, including HR and finance professionals, have long thought of the annual management charge (AMC) as the largest regular charge their employees pay on their accumulated investments in the pension scheme. Some HR/finance managers represent the AMC as the only charge a pension scheme member pays from their fund. In reality the AMC can be only a fraction of the costs.

A good way of imagining this is to consider the investment fund as a volume of money, from which fees and charges are deducted before the remaining amount is divided between members and allocated to each person’s account. Once the money is in the individual’s account the AMC is deducted.

Another way of thinking of the charges, other than the AMC, is to think of them as a regular deduction from the performance of the fund, irrespective of whether there are members or not. They reduce the gross value, perhaps on a daily basis, as they are deducted. These other charges are added to the AMC to create the total expense ratio (TER) or, now, the ongoing charges figure (represented as OGC or OCF).

We have to stop thinking that if the AMC seems reasonable, the fund is value for money. Only when you know what the total charges are, can you take a view. For instance, comparing two funds with an AMC of 0.50% means nothing because one may have double the other in extra charges. A multi asset fund for example – often used in DC schemes as a variety labelled a ‘diversified growth fund’ – may have something like an extra 2% of costs including transaction fees over the AMC. Even a lower cost passive fund may really cost twice as much as the AMC.

The diagram below shows the main components of investment charges. Rules have changed recently and I’ve shown the terminology applicable before and after (broadly speaking) the retail distribution review date of January 2013. For funds of funds there would also be fees for the additional underlying funds. You will note that transaction charges are not reported in any of the notifiable components. This is a controversial area. First, it’s complicated to derive an accurate amount (which is no excuse) but there is a good point that more transactions may be adding value – but then again, maybe sometimes they are not. Transaction charges are not visible so we don’t know the impact they have on performance.

There is pressure within the industry to improve transparency but this is work in progress.

With the default fund on auto enrolment schemes being capped at a 0.75% OGC from April 2015, movement is in the right direction and future years will see further improvement.

Pension Guidance Guarantee – the rules

The Chancellor announced in the 2014 Budget that all defined contribution (DC) savers would be entitled to free, impartial guidance at the point of retirement. The Financial Conduct Authority (FCA) recently released its ‘near final rules’ on the delivery of the Pensions Guidance Guarantee which you can read here:

PS14/17 Retirement Reforms and the Guidance Guarantee, including feedback on CP14/11

As pension providers must notify their upcoming retirees of the guidance available from April, there is not much time to get ready. Hence the ‘near final rules’ as the bill is not expected to be passed until early 2015.

The FCA is proposing a suite of principles-based standards to ensure that the guaranteed guidance is impartial, consistent, of high quality and is engaging across a range of delivery channels. The proposed standards cover subjects such as:

The FCA said it had strengthened the standards following a consultation earlier this year. It said the tougher rules for delivery providers – The Pensions Advisory Service and Citizens Advice – ensure they fully meet the aims and objectives of the policy – “ensuring consumer confidence and the delivery of helpful guidance for consumers”. Changes to the standards cover how complaints should be dealt with; how the outcome of the guidance guarantee session should be recorded; and how those delivering the guidance should work together to ensure that all those accessing the service get a consistent outcome.

FCA director of policy, risk and research Christopher Woolard said: “Any decision about your pension has far-reaching consequences that often cannot be reversed. The pensions’ landscape will fundamentally change from April 2015 so it is important that people get support to enable them to make the right choices about what to do with their retirement fund.”

The FCA also outlined some detail on plans for monitoring and enforcing the standards, with further guidance to be issued early 2015. The cost of the guidance will be borne by the industry in the following amounts:

| Deposit acceptors | 22% |

| Life insurers | 22% |

| Investment managers | 22% |

| Investment administrators and custodians | 22% |

| Advisers, dealers, brokers | 12% |

| 100% |

Relief for DB schemes that need to wind up but can’t

There is something called Section 75 debt which is from S75 of the Pensions Act 1995. It is the debt that relates to the outstanding deficit of a scheme when a sponsoring company ceases to exist or sponsor the fund.

It can take years for a wind up of a pension scheme to be finalised if payment of this debt is not forthcoming from the plan sponsor. During that time, members of the scheme cannot finalise their pension arrangements. Members can die waiting before they get their portion of the pension entitlement from the fund. So it was good news when this month the high court ruled that a scheme’s trustees could sell its s75 debt on secondary markets.

The Icelandic bank, Kaupthing, Singer and Friedlander (KSF) collapsed in 2008, entering administration and leaving its UK pension scheme without a sponsor. It was owed a s75 debt of around £74m from the bank’s administrators, but, with the bank’s winding-up process expected to take until 2018, trustees requested permission to sell its debt on the secondary market.

In a ruling the High Court said the debt was assignable, and trustees could seek a third-party buyer on the secondary market. The scheme found an undisclosed purchaser that will seek repayments from KSF’s administrators, allowing the scheme to wind up without further delay and to distribute assets to improve pensions being paid to members much sooner that would otherwise have been possible.

Pension administrators to be swamped by cash requests

The Pensions Advisory Service (TPAS) has warned that scheme trustees and administrators risk being overwhelmed in April by members eager to access their pensions as cash at the earliest opportunity, having waited a year for the pension freedoms announced in last March’s budget to come into effect.

The new rules will reduce the tax charge on taking pension pots as a lump sum, and make it easier for scheme members to draw down from their savings (as long as they are aware of the annual tax threshold or they could pay more tax than they expect).

Defined contribution scheme administrators are being urged by industry bodies to start contacting members due to retire in April, but research suggests less than half of employers will have systems in place to deliver on the new retirement options. And the treasury hasn’t yet finalised the rules!

However it is likely that members will want to get access to their cash as soon as possible and will be unhappy with a long wait. They will be even unhappier when they find out many pension schemes will not have any process or rule changes in place to do it at all.

The press reported that 1 in 8 people plan to cash in their whole pension in 2015. The Treasury expect around 130,000 people a year (up from 5,000 a year) will choose to take cash from their pension pot when the new rules come into force, generating an estimated windfall of around £3.8 billion over five years for the Treasury.